Do you know who the guy in the picture below is?

Picture courtesy of the New York Times

Picture courtesy of the New York Times

The guy’s name is Keith Gill and he lives in Wilmington, Massachusetts (close to Boston, USA). He is also known by his nickname on Reddit as DeepF##kingValue (apologies, I can’t use the full nickname since that may offend younger readers). I am not on Reddit but apparently it is frequented by amongst others, day traders – those people who discovered trading on stock markets during hard lockdown. Gill is a chartered financial analyst (CFA) and until recently worked for a life insurance company in marketing. Unbeknown to his employer at the time, he also masqueraded as an investment guru who has his now youtube channel called “Roaring Kitty”. He recently resigned after much success on the stock market. Gill has been trading in all sorts of unpopular shares such as GameStop, the bricks and mortar video games retailer. I have not frequented a GameStop store but there are over 5,500 outlets, mainly in the USA. Apparently, you can find everything you need to embark upon a gaming adventure. You can buy video games hardware, software and accessories in their stores. GameStop has been in decline for some years and has been badly hurt by the lockdown. We know what is happening to the retail industry globally as many larger groups have gone asunder. Companies such as Sears, JCPenny and J.Crew are no more.

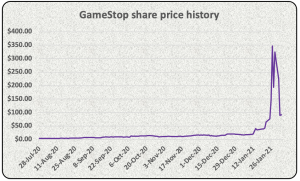

I would have thought that GameStop was not a good share to purchase for various reasons. Its business model is being fundamentally challenged by online channels. It has been making losses for the past couple of years. The numbers don’t look good – I have attached an Excel spreadsheet GameStop analysis (Feb 2021) analyzing their numbers if that’s your thing. Mr. Gill has thought otherwise for some time. On 28 July 2020 he posted a rather lengthy rant on youtube about why GameStop is a compelling share to buy. He backed his convictions by apparently investing over US$50,000 of his own money in this unloved share called GameStop. The share price was US$3.94 on 28 July 2020. The GameStop share price doubled in value by 15 September 2020 and then surged in January 2021 reaching a record high of US$481.99 on 28 January 2021. That is a staggering surge in the share price. If we had invested US$50,000 on 28 July 2020 following Mr. Gill’s advice, we would have been up US$23.9 million if we sold out on 28 January 2021. I would have been thinking about retiring and setting up my own foundation called “HowtoWhackthoseHedgeFunds”.

There have been wild gyrations in GameStop’s share price over the past month. After reaching a peak of US$481.99, it declined to US$325.00 a day later. It closed at US$100.00 yesterday. The other remarkable thing about the trading in GameStop’s shares has been the volumes exchanging hands. On 26 January 2021, 178.6 million GameStop shares traded hands. That in itself may be unremarkable to some except when you consider how many GameStop shares are in issue. At 31 January 2020, its latest reported financial year-end, there were 64.5 million shares in issue.

Ordinarly, we would have congratulated Mr. Gill and his followers on Reddit for being brave enough to invest in GameStop and fair change for making many millions. However, the plot thickens. It transpires that there were some hedge funds that had shorted the GameStop shares. Without getting overly technical, short selling involves borrowing GameStop shares from some investment bank and then selling these shares on the stock market. The investment banks would require some collateral from you and would charge you some juicy fees for engaging in this unusual behavior of selling something you do not own. Short sellers would then pray that the GameStop share price would decline as they then could purchase shares at a lower price than they had sold for, making a nice profit. Hedge funds are known for identifying unloved shares such as GameStop or seemingly overpriced shares such as Tesla and engaging in short selling. Imagine that we ran a hedge fund that had engaged in short selling GameStop shares. Let’s say we had sold 1 million GameStop shares that we had borrowed from an investment bank for US$5.00 each in the firm belief that the share price will plummet to zero. The likes of Mr. Gill and his fellow day traders then unfortunately arrived and drove the share price up to US$400 per share. The hypothetical hedge fund would be in a world of pain – some US$395 million of pain since to purchase those 1 million GameStop shares would now cost US$400 million in order for us to honor our promise to return those shares to the investment bank.

It seems as if stock markets have gone mad and the man in the street can now topple the mighty financial giants such as hedge funds. Is it a game changer? Me thinks not. These hedge funds are going to spend some money lobbying Washington to ensure that the rules change to prevent these unfortunate incidents from ever happening again.

Stay safe and all the best for February 2021 – I am now thinking in months as opposed to years given this COVID mayhem. All the best from BeechieB.

Leave a Reply